In this lesson, we’ll talk about your church’s statement of cash flows. The phrase “Cash is King” is very common in the for-profit world, but the statement definitely applies to churches as well. It’s impossible to keep your church running if the church doesn’t have the cash necessary to pay the bills. Keeping track of your church’s cash flows is very important and the statement of cash flows can help your church leaders understand the cash flow situation.

The statement of cash flows shows the all the inflows of cash to your church and all the outflows of cash from your church. Common cash inflows include money received from contributions, tithes, fundraisers, or grants. Common cash outflows include money used for utilities, rent, upkeep, wages, and taxes. Basically this statement shows where your church gets its cash and how it uses its cash.

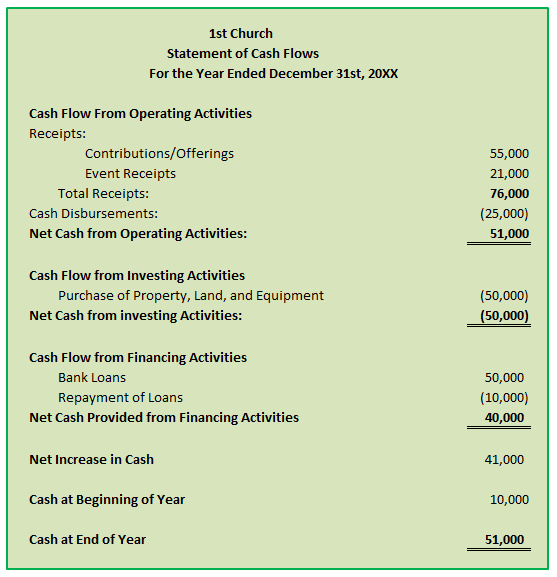

An Example Statement of Cash Flows

As you study the above statement of cash flows, notice that it’s broken into three different sections: Cash Flow from Operating Activities, Cash Flow from Investing Activities, and Cash Flow from Financing Activities. The statement is broken into three different categories to make it easier to see where your cash is coming from and where it’s going.

Accounting Note: Any time you see numbers in parenthesis on an accounting report this means that the number is negative and should be subtracted. In the above example total receipts equaled $76,000. Total disbursements ($25,000) in parenthesis means that you subtract $25,000 from $76,000 to get your net cash received.

Cash Flow from Operating Activities

This section represents all the cash received and used for the normal day-to-day operations of the church. Weekly contributions and tithes will be recorded as inflows in this section and the day-to-day expenses will be recorded as outflows in this section. In the example above, the total inflow from operating activities is $76,000. The total outflow is $25,000. The net or surplus cash from operating activities is $51,000 for 1st church (the church used in the example above).

Here’s one good rule of thumb for knowing which cash flows to put under the operating activities section: If it doesn’t fall under investing activities or financial activities (defined below), then it’s an operating activity.

Cash Flow from Investing Activities

The term ‘Investing Activities’ is referring to cash inflows and outflows from purchases or sales of long-term assets (or investments) like land, buildings, and equipment. Long-term assets are assets that will have a useful life of more than one year. If your church purchased $50,000 worth of land this year, then this would be recorded in the investing activities section as an outflow (as in the example above).

Any investments you make in stocks, bonds, t-bills, etc. are also recorded in this section. If your church invests in the stock market, this would be a cash outflow. If your church sold these investments it would be a cash inflow. Oddly enough, the interest or dividends received from these investing activities are reported in the operating activities section (one of the quirks of accounting).

Cash Flow from Financing Activities

For churches, financing activities include taking out a note from the bank (borrowing money from the bank), repaying the note or debt, and receiving permanently restricted contributions (long-term endowments). In the cash flow statement above, the church borrowed $50,000 from the bank (an inflow) and it paid back $10,000 worth of its debts (an outflow).

Preparing the Cash Flow Statement

In general there are two methods for preparing the cash flow statement: the direct method and the indirect method. We won’t go into detail about these two methods here. I may show you how to do this in a future lesson for those interested, but most church accounting software can do this for you automatically.

Conclusion

Today we learned that keeping track of cash is a very important part of keeping the church finances going. The cash flow statement summarizes all the inflows and outflows of cash into three sections: operating activities, investing activities, and financing activities. Operating activities represent the day-to-day transactions and everything not included in the investing and financing sections. Investing activities include the purchase and sale of marketable securities (bonds, stocks, etc.) and long-term assets (buildings, land, and equipment). Financing activities include loans, debt repayment, and permanently restricted contributions.

We’ve just about done all the reporting necessary for a church! We’ve covered the major financial statements, in the next lesson we’ll talk about the year-end contribution statement.